文章

2023 Updated Guide to FSIE (Foreign-sourced Income Exemption Regime)

暂时只提供英文版本

To address tax avoidance and double non-taxation, the Foreign-Sourced Income Exemption (FSIE) regime has been introduced in Hong Kong. The move was prompted by Hong Kong’s inclusion in a 2021 watchlist by the European Union (EU), which identified Hong Kong as one of the jurisdictions with potentially harmful tax regimes. The FSIE regime, effective from 1 January 2023, aims to enhance economic substance requirements and anti-abuse rules.

.

Incomes Covered by the FSIE Regime.

Hong Kong’s Foreign-Sourced Income Exemption (FSIE) regime encompasses four categories of foreign-sourced passive income:

.

• Dividend Income;

• Interest Income;

• Share disposal gains; and

• Income derived from intellectual property (IP).

.

FSIE regime applies only to foreign-sourced income received within Hong Kong. To qualify as ‘received in Hong Kong’ under the FSIE regime, the income must meet specific criteria:-

• Remittance, transmission, or being brought into Hong Kong, typically implying a transfer into a local bank account or integration into

the Hong Kong economy;

• Utilisation to offset trade, profession, or business-related debts in Hong Kong; and

• Use for the purchase of movable property subsequently brought into Hong Kong.

.

Entities Impacted by the FSIE regime

.

The Foreign-Sourced Income Exemption (FSIE) regime specifically targets members of multinational group entities (“MNE entities”) engaging in trade, profession, or business within the region, which receive foreign-sourced income in Hong Kong, but have little or no economic substance in Hong Kong. The primary objective of this FSIE regime is to prevent MNE entities from exploiting the benefits of double non-taxation. However, the FSIE regime does not apply to the following : –

• Independent local enterprises with no offshore operations;

• Companies in purely local groups, with no overseas constituent entities; and

• Individual taxpayers.

Furthermore, regulated financial entities and MNEs benefitting from Hong Kong’s pre-existing preferential tax regimes are typically exempt from the new FSIE regulation, subject to the conditions discussed below.

.

Exemption Conditions under the FSIE Regime

.

MNE entities can qualify for exemption under the FSIE regime through three routes: –

.

1. the Economic Substance Requirement (ESR),

2. the Participation Exemption, and

3. the Nexus Exemption.

.

It is important to note that these exemption conditions vary for each type of foreign-sourced income. The specific exemptions available for each income type are summarised in the table below:-

.

Economic | Participation Exemption | Nexus Exemption | |

Interest Income | ✓ | ||

Dividend Income | ✓ | ✓ | |

Share Disposal Gains | ✓ | ✓ | |

IP Income | ✓ |

.

Economic Substance Requirement

.

The Economic Substance Requirement (ESR) applies to foreign-sourced interest income, dividend income, and share disposal gains under the FSIE regime. ESR requires MNE entities to demonstrate Hong Kong’s economic substance based on international standards to claim offshore benefits. Adequacy tests are employed, which involves (1) employing a sufficient number of qualified employees and (2) incurring an appropriate level of operating expenditure in Hong Kong related to the relevant activities. Outsourcing is allowed with adequate supervision and meeting outsourcing requirements.

.

The specific requirements for the number of employees and expenses vary on a case-by-case basis, but pure equity holding companies with dividend income and equity interest disposal gains are subject to less stringent requirements. Non-pure equity-holding entities receiving interest income must show that relevant strategic decisions and loan financing arrangements occur in Hong Kong before applying the interest income source rule, such as the credit test or operation test.

.

Participation Exemption

.

The participation exemption under the FSIE regime applies to foreign-sourced dividend income and share disposal gains. To qualify, the following conditions must be met: –

• the recipient of the income (holding company) must be a Hong Kong tax resident, or a firm establishment of a non-tax resident; and

• The income recipient must hold a minimum of 5% of shares or equity interest in the concerned investee entity for a continuous period

of at least 12 months before earning the passive income.

.

Under the Inland Revenue Ordinance (IRO), the participation exemption is subject to the following anti-abuse rules aimed at preventing misuse: –

• Switch-over rule: The investee company must have a corporate income tax rate of at least 15%;

• Main purpose test (General Tax Anti-Avoidance Rule): If the Inland Revenue Department determines that the primary objective

of the entire arrangement is to avoid taxes, the participation exemption will not be applicable; and

• Anti-hybrid mismatch rule: The dividend payments made by an investee company must not be tax-deductible.

.

Nexus Exemption

.

The Nexus exemption in the FSIE regime provides tax exemption for foreign-sourced passive income from patents or software-related copyrights. However, marketing-related IP assets like trademarks and copyrights do not qualify for this exemption and are taxable.

.

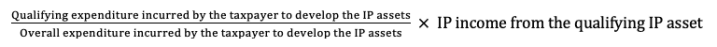

Tax-exempt IP income is calculated by the following formula:

In respect of qualifying expenditure, it should be noted that: –

.

• The R&D work can be conducted by the taxpayer itself or outsourced to an unrelated party, regardless of location;

• If the R&D work is outsourced to a related party, it must be conducted in Hong Kong;

• IP acquisition costs are not considered qualifying expenditure;

• Qualifying expenditure can be increased by 30% (up to the limit of total operating expenses);

• Outsourcing R&D work to overseas parties limits offshore benefits;

• R&D expenses paid to overseas group companies are generally not tax-deductible;

• If IP income does not qualify for offshore benefits, significant Hong Kong Profits Tax liabilities may arise.

.

The table below summaries the corresponding designated income types and requirements.

.

Exemption | Economic Substance Requirement (ESR) | Participation Exemption | Nexus Exemption |

Passive Income(s) Applicable | – Interest Income | – Dividend Income | – IP Income |

Requirement (s) | – Employ a sufficient number of qualified employees; | – Recipient must be a Hong Kong tax resident or a firm establishment of a non-tax resident; | – Only applies to qualifying IP assets (patents, software-related copyrights); |

.

Evaluating Exemptions Conditions under FSIE Regime

.

Advanced Ruling

To reduce compliance burdens for MNE entities, the FSIE regime includes an advanced ruling provision. MNE entities can apply for advance ruling with the IRD. Once granted, the ruling is legally binding and valid for up to five years. Applications can be made individually by the MNE entity or on behalf of a group. Group applications are subject to specific requirements, such as specified economic activities should be outsourced to a single entity through a joint service agreement. Written approval from other MNE entities and the submission of the service agreement are also necessary.

.

Applications can be submitted at any time. It typically takes about 21 working days for the IRD to process an application. If the ruling is favourable, the MNE entities will be granted the profit tax exemption under the FSIE regime. In case of an unfavourable ruling, MNE entities have the opportunity to explore alternative tax planning strategies, such as business restructuring, to enhance tax efficiencies. However, it is not advisable for MNE entities to apply for the advanced ruling without first seeking professional advice, as it may impact the final outcome.

.

Conclusion

With the implementation of the Foreign-Sourced Income Exemption (FSIE) regime in Hong Kong, it is high time for MNE entities to prepare for this new regulatory landscape to minimise the impacts on their tax obligations for passive income.

.

At ONC Lawyers, we are ready to answer your questions, offer personalised tax guidance, and help mitigate the effects of taxation reform. With our expertise and professionalism, we are well-positioned to secure your company’s future. Contact us today to schedule a consultation.