Newsletter

Relaxation of Procedures of claiming treaty benefits in the People’s Republic of China (“PRC”)

In October 2019, the State Taxation Administration (“STA”) issued Administrative Measures on Non-resident Taxpayers Claiming Tax Treaty Benefit (STA Public Notice [2019] No.35 (“PN 35”)), which took effect from 1 January 2020. The application procedures of claiming tax treaty benefits in the PRC by non-resident has changed from “Record-filing Procedure” (備案制) to “Retaining Documents for Inspection Mechanism” (備查制). In particular, non-resident taxpayers can claim the tax treaty benefits provided that they have collected and retained relevant supporting documents for future inspection by the PRC tax authorities.

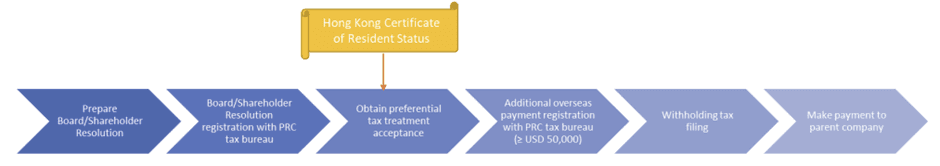

The whole application procedure should take around one month. The procedures are shown as below:

Article 7 of PN 35 stipulates that the documents required to be retained include non-resident taxpayers’ Certificate of Resident Status (“CoR”) for the current or previous calendar year where dividends are derived, resolution of the board of directors/shareholders. Although the non-resident taxpayers are not required to submit the CoR by the time of the dividend remittance; the CoR should be in place for inspection by the PRC tax authorities anytime after the remittance.

As such, the non-resident taxpayers are still responsible for making appropriate self-assessment on their treaty benefit eligibility and retaining relevant documents (e.g., CoR) under the new application system. If they fail to fulfil the requirements, the PRC tax authorities may reject their application for treaty benefit and request them to settle the underpaid withholding tax plus late payment surcharge.

Points to note:

When applying for the treaty benefit (e.g., preferential withholding tax rate on dividends) in the PRC, the applicants would also have to submit the latest audit report. Please note that the PRC company is required to retain 10% of the annual statutory net profit (after offsetting any prior years’ losses) as statutory reserve funds before the dividend distribution under the PRC Company Law. In addition, the details of the net profits and statutory reserve funds are required to be disclosed in the resolution of the board of directors/shareholders..

If you would like to know more information related to the application, please feel free to contact us.