Radical Change in the IRD’s Attitude on Offshore Claim of Interest Income: One-off Loan does not equal to “Simple Loan Arrangement”

IRD: Operation test would be the default test in determining the source of profits (interest income)

“Provision of credit test” has always been under the impression to be the dominant source rule for interest income, except for financial institutions and money lenders. Many taxpayers and tax representatives consider that, once the borrower is located outside Hong Kong or the loan funds are made to a non-Hong Kong bank account, the interest income will be offshore sourced and not subject to Hong Kong Profits Tax. However, this is certainly not the case now, at least from the view point of the IRD.

In the 2023 annual meeting between the IRD and the HKICPA, the IRD clarified that "provision of credit test" is applicable only when it is a "simple loan arrangement". More surprisingly, the definition of “simple loan arrangement” is quite narrow from the IRD’s view.

The IRD has pointed out that one-off loan does not infer simple loan arrangement. Operation test may also apply, and thus if the Hong Kong company maintained economic substance in Hong Kong, even though the borrowers may be from outside Hong Kong, the interest income will be onshore sourced and taxable.

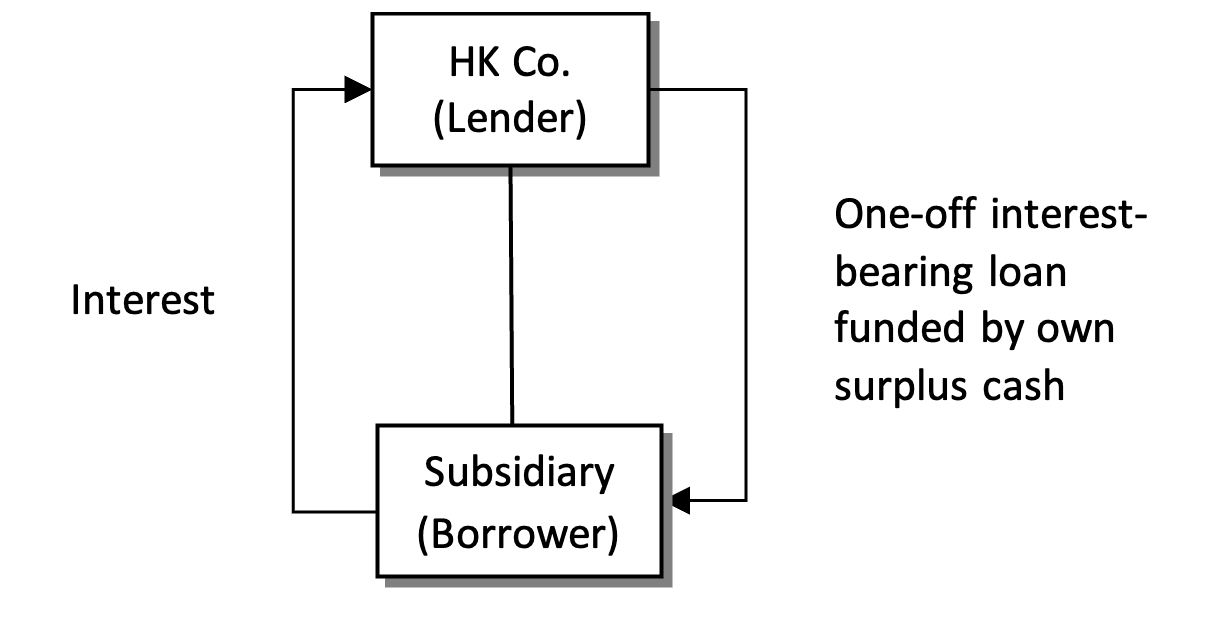

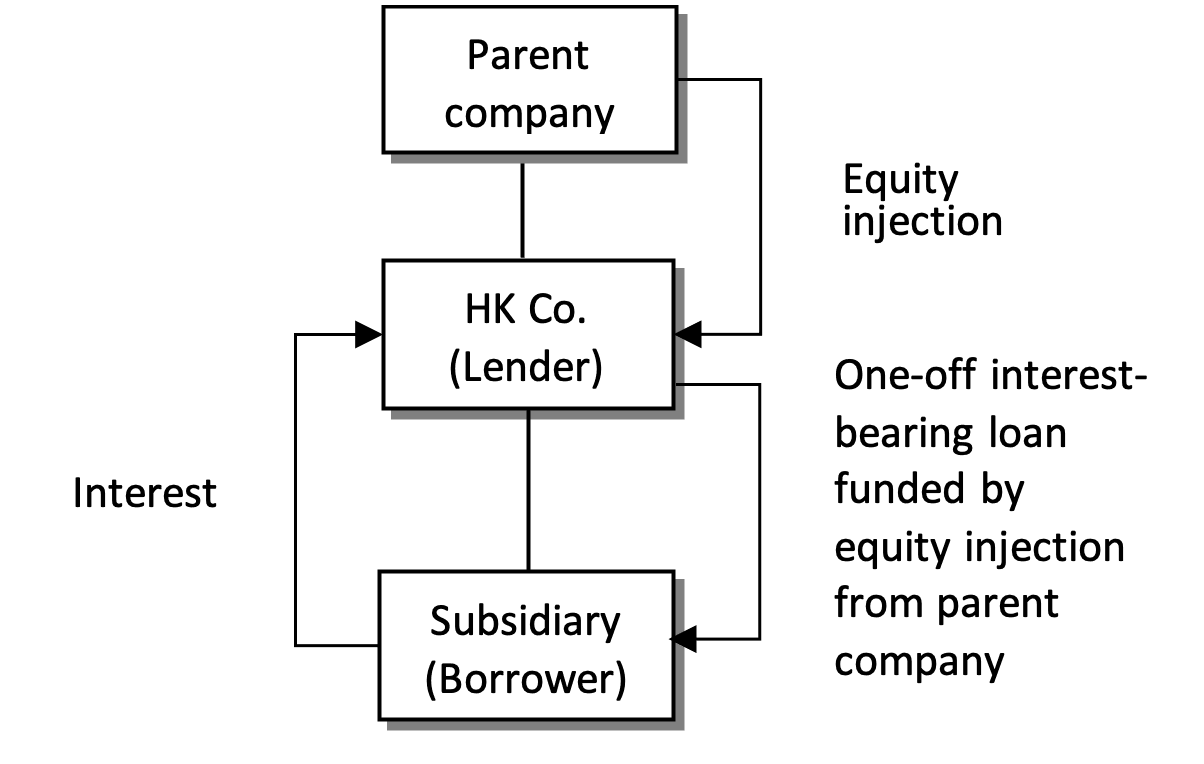

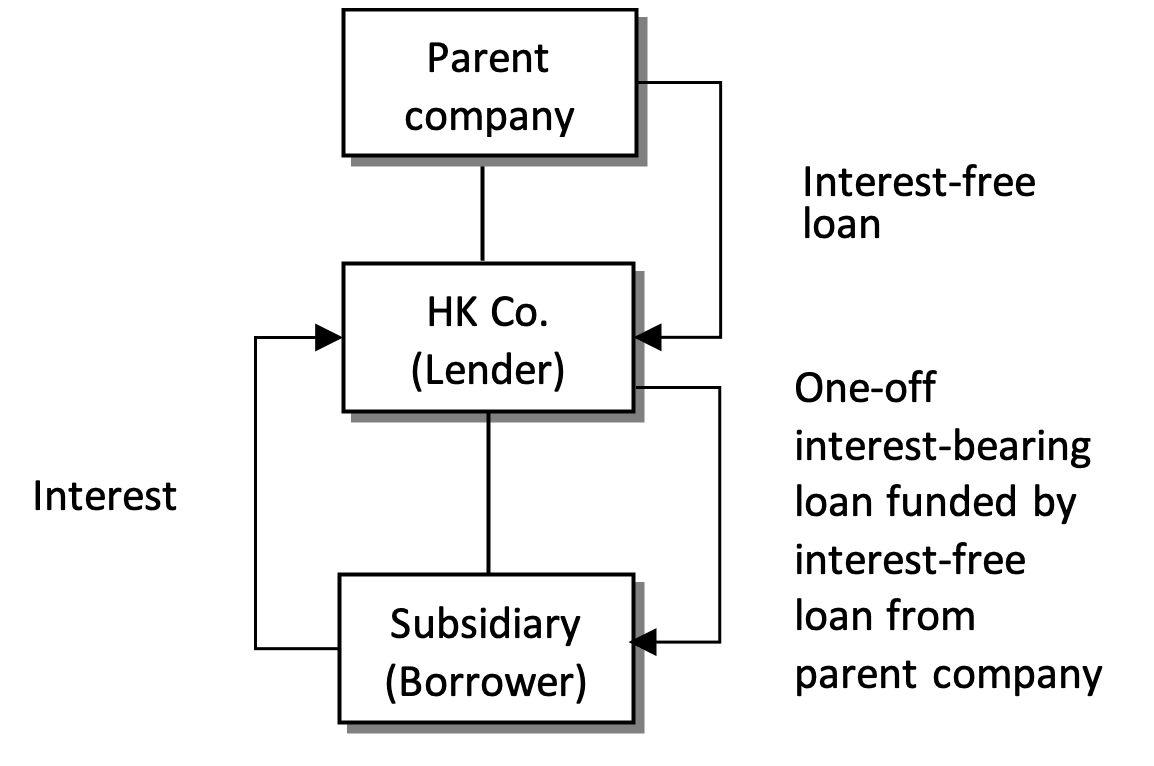

The below 3 scenarios are raised by the HKICPA and discussed during the meeting:

Source of fund of lender | Diagram | Operation test / Provision of credit test |

Own surplus cash |

| Provision of credit test |

Share capital from parent company |

| Provision of credit test |

Shareholder loan from parent company |

| Operation test |

Particular attention should be made to Scenario 3 in which “on-lending” activities appear. From the IRD’s view, the Hong Kong company does not use its own funds for lending to the subsidiary. Instead, it has borrowed money from others (e.g., the parent company) to support the lending activities. As such, operation test should apply.

Overall speaking, in the past, the frequency of lending tends to be the major criterion to determine whether it is a simple loan arrangement or not. However, the IRD now considers that whether on-lending activities exist seems to be very important as well (i.e., whether the lender borrows money from others, no matter third-party companies or related companies, for on-lending purposes).

Reference:

https://www.hkicpa.org.hk/-/media/Document/APD/TF/Tax-bulletin/034_April-2024.pdf

Points to note