Newsletter

IRD Clarifies “Received in Hong Kong” Definition under Foreign-Sourced Income Exemption (FSIE) Regime

Favorable treatment for mixed pool of funds in offshore bank accounts, but uncertainties remain

In the 2023 annual meeting with the HKICPA, the IRD clarified “received in Hong Kong” definition under FSIE Regime. Surprisingly, a significant portion of our clients rely on not “received in Hong Kong” to fulfill the FSIE requirements, as they are unavailable to fulfill other requirements like economic substance requirement or participation requirement. However, they seem to have a misunderstanding on the definition of “received in Hong Kong”.

Let us recap the definition of “received in Hong Kong” under FSIE regime:

- Remittance, transmission, or being brought into Hong Kong, typically implying a transfer into a local bank account or integration into the Hong Kong economy;

- Utilization to offset trade, profession, or business-related debts in Hong Kong; or

- Use for the purchase of movable property subsequently brought into Hong Kong.

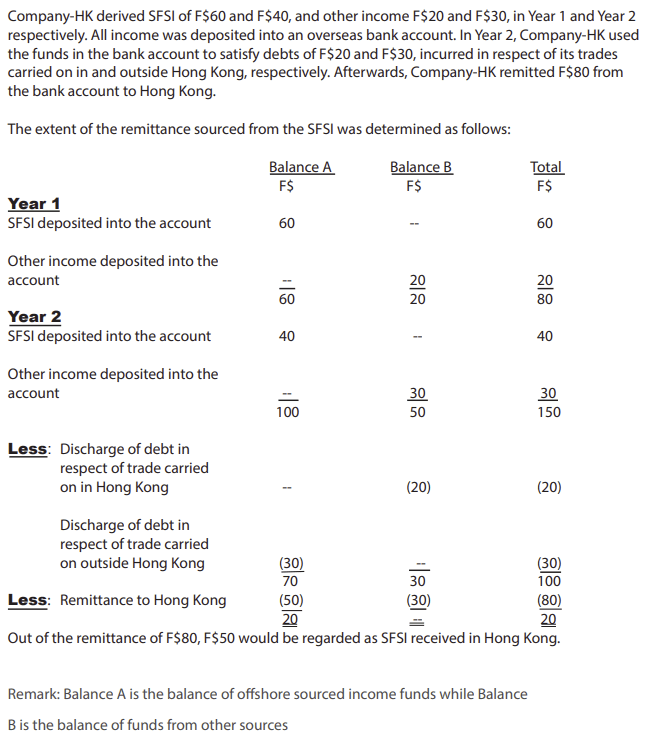

The definition of “received in Hong Kong” is broad. In the 2023 annual meeting between the HKICPA and the IRD, the IRD addressed the situation in which the taxpayer keeps a non-Hong Kong bank account where both funds from offshore sourced income and funds from other sources are deposited in the same bank account.

We extract two key points of the IRD’s attitude under the situation of “mixed funds”:-

- The taxpayer should clearly distinguish the bank deposit originated from offshore sourced income and originated from other sources. Detailed records and documentary evidence have to be maintained and this is the first priority. For taxpayers who did not maintain a clear record, the IRD would likely consider that all the funds were originated from offshore sourced income.

- When one of three above-mentioned “received in Hong Kong” conditions is triggered, the IRD endeavours to adopt a favorable tax treatment that the funds were first presumed to be sourced from other sources first, and then followed by sourcing from offshore sourced income. For instance, if the amount of funds remitted to Hong Kong bank accounts is less than the amount of funds from other sources, none of the offshore sourced income will be considered as “received in Hong Kong”, and thus the FSIE requirements are still considered to be fulfilled.

The illustrative example in the meeting can be found on the last page of this section.

Reference:

https://www.hkicpa.org.hk/-/media/Document/APD/TF/Tax-bulletin/034_April-2024.pdf

Points to note

- It has always been our advice that taxpayers should not only rely on NOT “received in Hong Kong” to get around from FSIE requirements. First of all, the definition is broad and not clear. Secondly, it has high restriction on subsequent usage of funds. Taxpayers should work on fulfilling other requirements (e.g., economic substance requirements) at the same time to “buy additional insurance”.

- Despite the above-mentioned “favorable” tax treatment, we do not recommend a mixture of funds. If possible, a separate bank account should be set up to receive foreign sourced income under Hong Kong Profits Tax in order to avoid any tax dispute.

- For a bank account with mixed funds, it is important to not only keep track of every fund inflow, but also every fund outflow, so that we can identify the balance of foreign sourced income and balance of other sources just before some funds are transferred out as “received in Hong Kong”.

- If taxpayers would like to obtain upfront certainty on the compliance with FSIE requirements, it is strongly recommended to apply for an advance ruling under FSIE Regime. The advance ruling under FSIE Regime is much simpler than advance ruling for other tax issues.

Remark: Balance A is the balance of offshore sourced income funds while Balance B is the balance of funds from other sources.