Newsletter

In the past, many corporations tend to disregard their Country-by-Country (“CbC”) compliance obligation. They consider that CbC return does not offer much help to the IRD in reviewing the tax position, and thus tend to believe that the IRD would not check whether a taxpayer has already reached the threshold of CbC filing and whether they have missed the due date of both CbC notification and reporting.

However, it does not seem to be the case anymore...

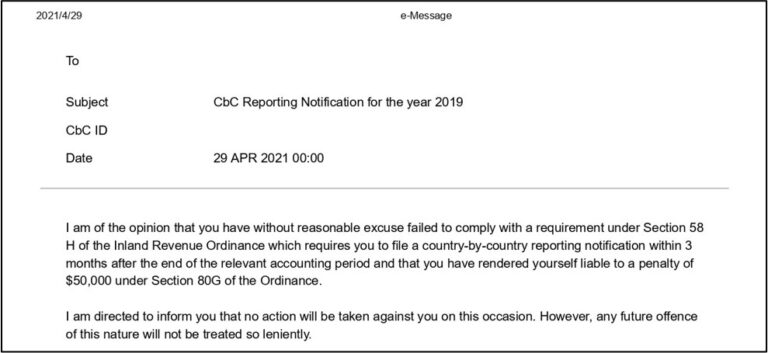

One of our clients has recently received the below message in the CbC reporting portal :

It seems the IRD is now checking the prior years’ filing status of each taxpayer and issue similar warning to taxpayers who have been late in CbC Reporting in prior years, despite the fact that the taxpayer may have already completed the procedures long time ago.

More importantly, the IRD has explicitly pointed out that, for any subsequent late CbC filing, it will most probably impose penalty on the taxpayers as the IRD is likely to waive penalty on first time offence only.

Points to Note

Let us recap the threshold of CbC Filing in Hong Kong:-A multinational enterprise (“MNE”) group is required to file CbC Return in Hong Kong when both of the below conditions are satisfied:-

Annual consolidated group revenues of the MNE in the preceding accounting period exceed the threshold (HK$6.8 billion for a Hong Kong ultimate parent entity or EUR750 million for other cases); and

The MNE maintained entities in Hong Kong as well as overseas.

We note that there are a number of MNE group which are still unaware that they are required to fulfil to the CbC requirements. They may consider CbC is irrelevant to them because the business scale of the Hong Kong company is small or the Hong Kong company only derives negligible amount of income. However, this does not take away their duty to file CbC as the threshold solely depends on the group consolidated data rather than Hong Kong company-level data.In view of the stringent attitude of the IRD, taxpayers should regularly check with their overseas headquarters on the group consolidated annual revenues. Taxpayers should take prompt actions to perform back-year CbC filing if necessary. If you would like us to assist in assessing whether your company is required to make the CbC notification, please feel free to contact our tax team members.