Our Services

Patent Box Tax Regime and Enhanced Tax Deduction on Research & Development (R&D)

Research & Development (R&D) Patent Box Tax Incentive

The Hong Kong Patent Box Tax Incentive, effective from the year of assessment 2023/24, offers a preferential tax rate of 5% on qualifying intellectual property income, significantly reducing corporate tax burdens and greatly encouraging R&D activities in Hong Kong. The aim is to the creation and commercialization of new intellectual property (IP).

In order to meet the requirements of the Patent Box Tax Incentive, the enterprises need to:-

• Make sure that the IPs originate from specific R&D activities. Additionally, they must meet the local registration requirements in

Hong Kong, particularly within a 24-month period after the commencement of the program;

• Maintain proper records and accurately track their R&D expenditures to precisely calculate the nexus ratio;

• Elect to apply for this tax incentive through the profits tax return.

Tax Incentive for Research & Development (R&D) – 200% / 300% Enhanced Tax Deduction

With a view to encouraging more enterprises to conduct R&D activities in Hong Kong, Hong Kong had already introduced the Enhanced R&D Tax Deduction regime in the year of assessment 2018/19.

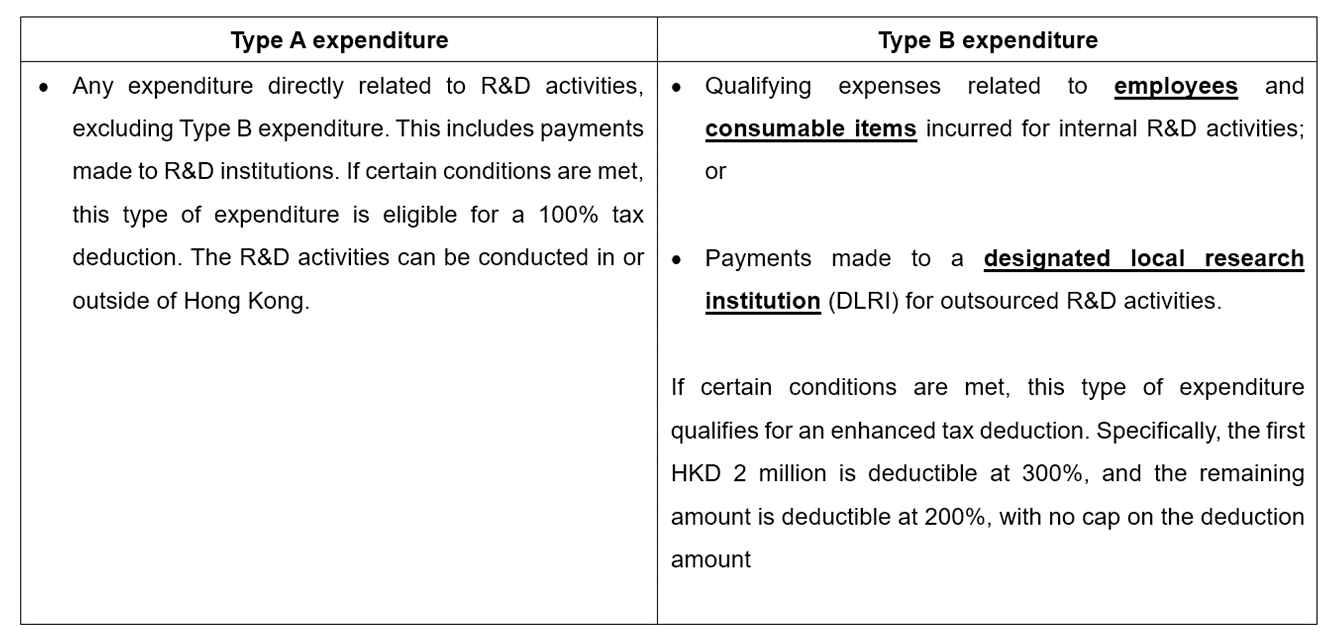

There are two kinds of R&D expenditures:-

• Type A expenditures which are eligible for the standard tax deduction of 100% of the expenditure amount;

• Type B expenditures which are eligible for the enhanced tax deduction at 300% for the first HK$2 million and 200% for the

remaining amount.

The expenditures which qualify as Type A and Type B expenditures are set out in the table below:-

Companies engaging in or planning to engage in R&D activities should review their R&D activities and assess whether they can benefit from the regime.

Key requirements

In order to obtain the R&D tax benefits, ALL of the relevant R&D activities have to be carried out physically in Hong Kong.

How to apply

Taxpayers should apply for the above tax benefits in their annual Hong Kong Profits Tax filing and fill in Supplementary Form S3.

How our services can help

We can assist you on the following services:

✓

with practical implementation plan;

✓

✓ Filling in of Supplementary Form S3 of Profits Tax return

✓

✓