Our Services

Hong Kong Single Family Office (SFO) Tax Concession regime / Tax Exemption

The Inland Revenue (Amendment) (Tax Concessions for Family-owned Investment Holding Vehicles) Ordinance 2023 (the Amendment Ordinance) was gazetted and came into operation on 19 May 2023. The Single Family Office (“SFO”) Tax Regime offers certainty to wealthy families establishing their offices in Hong Kong, ensuring that investment profits will be exempted from profits tax when specific conditions are met. It will apply retroactively from the 1 April 2022.

Single family office vs Multi family office

A single family office (SFO) is a dedicated entity established by a wealthy family to manage and optimize their financial affairs. SFOs exclusively serve the interests of that family, with customized services to meet the family’s unique needs and goals. This model is particularly suitable for affluent families seeking exclusive, highly tailored financial solutions and direct management of their assets.

A multi-family office (MFO) is a wealth management entity that serves the financial needs of multiple affluent families. MFOs pool resources to provide shared services, creating cost efficiencies and broader expertise. MFOs cater to families with significant wealth who seek professional guidance while benefiting from shared resources. By leveraging economies of scale, MFOs provide access to a diverse team of experts and investment opportunities, making them an attractive option for affluent families looking for comprehensive financial services without the specific need for a dedicated single family office structure.

SFC Type 9 license is generally required for a Multi family office (MFO), while no SFC Type 9 license is required for Single family office (SFO).

One of the key benefits of the SFO Tax Regime is profits generated from investment in the qualified assets are exempted from profits tax. This exemption typically applies to a wide range of financial assets, such as securities, stocks, bonds and deposits. In addition, any incidental income derived from holding the qualified assets is also tax-exempted, subject to a 5% threshold.

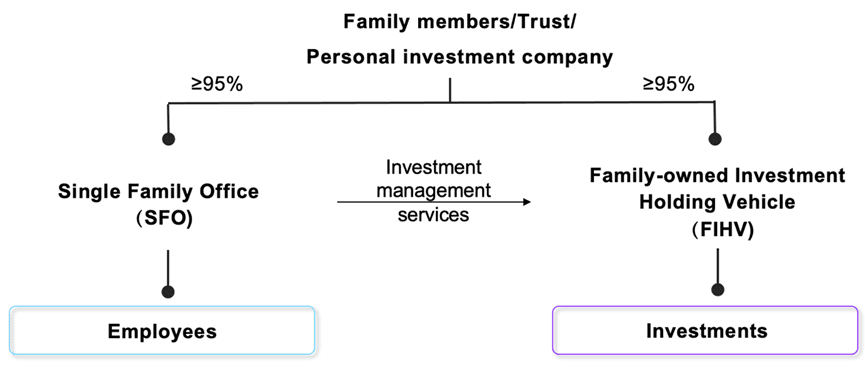

Typical SFO Structure

A typical single family office (SFO) structure consists of the following two entities:-

• Single Family Office

• Family-owned Investment Holding Vehicle (FIHV)

Requirements on Family-owned Investment Holding Vehicle (FIHV) by the IRD under SFO tax concession regime / tax concession

• Not a business undertaking for general commercial or industrial purposes;

• Relate to one or more than one member of a single family and meet the ownership requirements (i.e. at least 95% of the

beneficial interest of the FIHV must be held by the family except where a tax-exempt charity is involved);

• Normally managed or controlled in Hong Kong;

• Managed by an eligible SFO and meet the minimum asset threshold of at least HK$240 million; and

• Meet Substantial activities requirements: (i) at least 2 full-time qualified employees in Hong Kong and (ii) at least HK$2 million

operating expenditure incurred in Hong Kong.

Eligible SFO (IRD’s guidance) under SFO tax concession regime / tax exemption

• At least 95% of the beneficial interest of the SFO must be held by the family (except where a tax-exempt charity is involved);

• Provide services to the specified persons of the family and the fees for the provision of those services are chargeable to tax; and

• Fulfill the safe harbor rule whereby at least 75% of the eligible SFO’s assessable profits should derive from the services provided

to the specified persons of the family.

How our services can help

We can assist you on the following services:

✓

✓

✓

office (SFO) Tax concession Regime / tax exemption and the investments to be held in order to maximize your tax benefits.