Our Services

Hong Kong Shipping Tax Exemption

-

-

Hong Kong is an international maritime centre with over 150 years of maritime history, enjoying competitive advantage in high value-added maritime services with a strong maritime cluster. Recognizing the competitive landscape for maritime business in the region and subsequent to Hong Kong Government’s ambition to further attract the business presence of ship lessors as well as commercial principals of shipping activities (such as ship agents, ship managers and ship brokers), the Government has introduced ship leasing tax concession as well as shipping commercial principals tax concession in 2020 and 2022 respectively.

With the introduction of the above two tax concessions / tax exemption, Hong Kong currently has three types of tax concession available to shipping business. In this regard, Section 23B of the Inland Revenue Ordinance, since the introduction in 1992, has widely been used by most of the ship owners (which also includes a charterer) to get their shipping income exempt from Hong Kong Profits Tax being the exempt sums or offshore sourced incomes.

Below please find the summaries of three tax concessionary regime for easy reference.

Shipping industry players, in particular ship owners / ship operators and ship lessors, should pay close attention to the stance of the IRD, given that Section 23B and ship leasing tax concession in effect pose quite a lot of uncertainties, rather than clarities, to taxpayers and tax practitioners.

How our services can help

We can assist you on the following services:

✓

and the holding and business structure of multinational shipping enterprises;

✓

✓

✓

✓

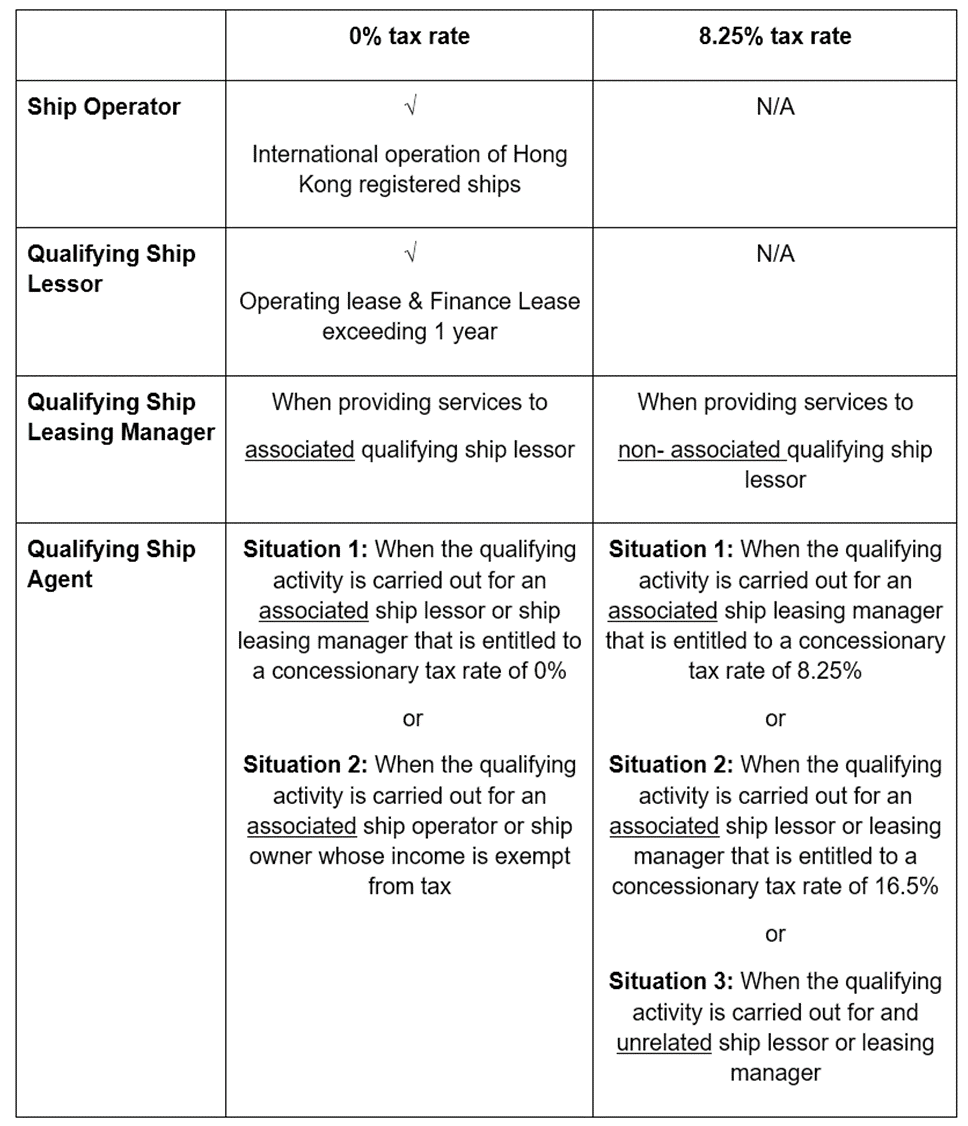

Table 1: Tax Concession / Tax Exemption Rate

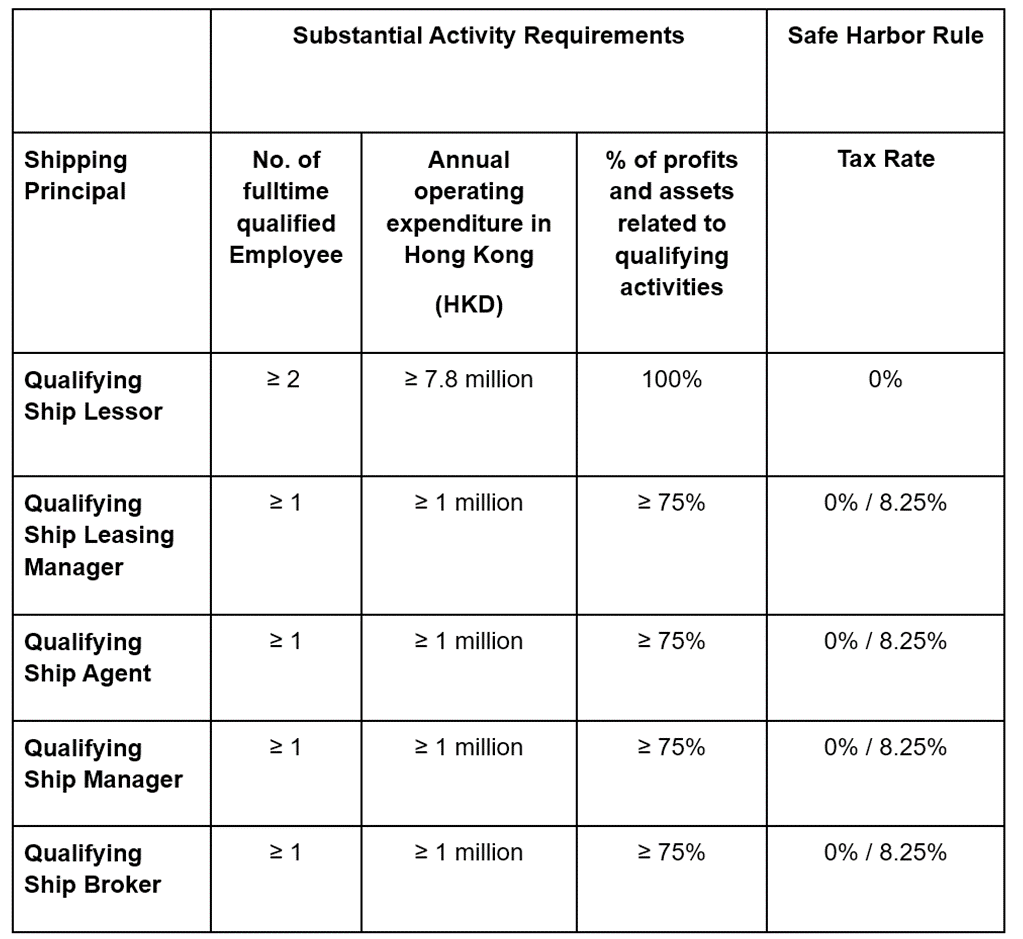

Table 2: Substantial Activity Requirements and Safe Harbor Rule