Our Services

Field Audit and Investigation

What is a tax field audit?

A tax field audit is a process conducted by the Field Audit and Investigation Unit of the Inland Revenue Department (IRD Unit 4) to ascertain the correctness of tax returns filed by taxpayers. If you have been selected for a tax field audit or investigation, you will normally be notified by letter in the first instance.

IRD selects taxpayers for field audit based on risk assessment and other factors such as the size and nature of the taxpayer’s business, the mode of operation of the business, the accounting policy and book-keeping procedures used within the business, the personal financial status of the taxpayer and associated persons, and the taxpayer’s personal and family living expenses.

Potential penalty for underpaid tax

Penalty action may be taken by the IRD in respect of failure to comply with any requirements specified under the Inland Revenue Ordinance The penalties for non-compliance may include a monetary penalty, prosecution, or both. The amount of the penalty will depend on the nature and severity of the non-compliance. The penalty may be a fixed amount or a percentage of the tax undercharged or not paid.

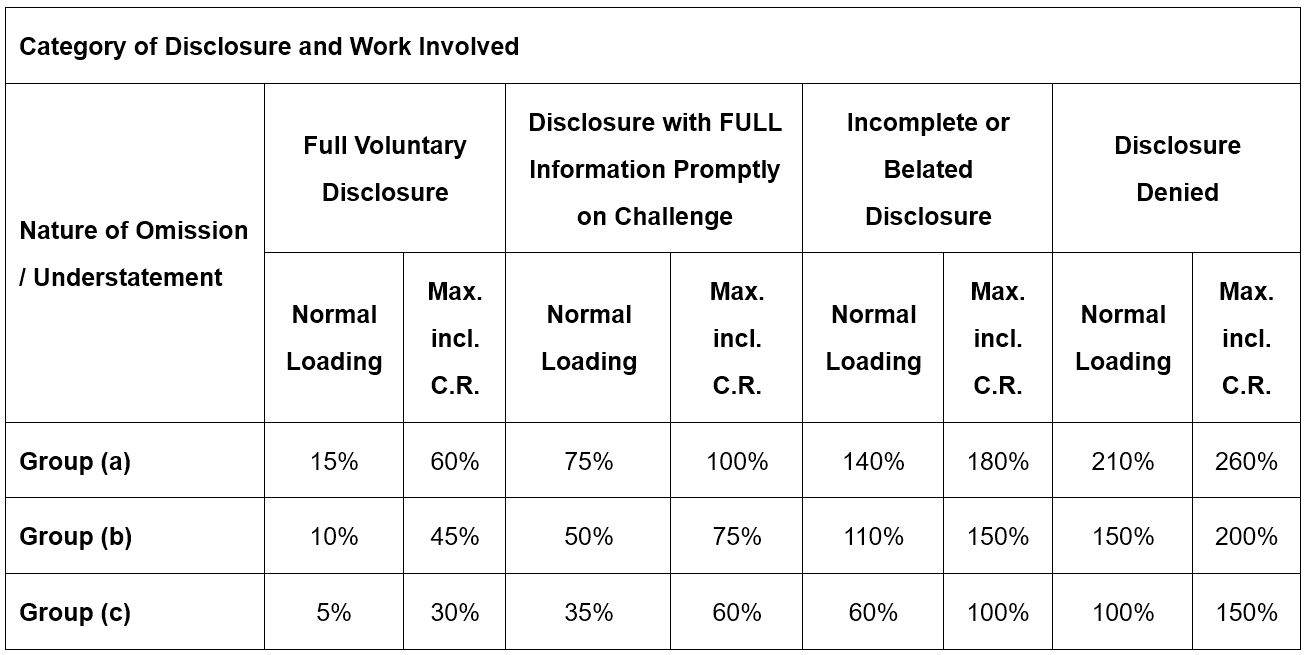

The below table summarizes the penalty loading scheme of the IRD.

Group (a) - cases where the taxpayers show intentional disregard to the law and adopt deliberate cover-up tactics involving the preparation of a false set of books, padded wage rolls and fictitious entries or multiple omissions over a long period of time.

Group (b) - cases with slightly less serious acts of omission resulting from recklessness including the "hand in the till" type of evasion, failure to bring to account sales of scrap, and sheer gross negligence.

Group (c) - cases where the taxpayers fail to exercise reasonable care and omit profits/ income such as lease premium, one-off commission, etc.

How our services can help

We are pleased to offer our assistance in handling tax investigations. We are dedicated to safeguarding your interests and pursuing the utmost favorable outcome with our knowledgeable and seasoned team of professionals.

Our services include:

✓

✓

✓

✓

✓

✓

✓

✓

✓