Articles

PRC Individual Income Tax Reforms (Series 1)

On 31 August 2018, the National People’s Congress of the People’s Republic of China (PRC) approved a number of reforms to the PRC Individual Income Tax (IIT) law, which came into effect on 1 January 2019. The definition of a ‘PRC individual tax resident’ attracted market attention due to its apparent stringency, while the introduction of anti-avoidance tax provisions has a significant impact on Mainland Chinese nationals. In this article, we will study the definition of a PRC tax resident and its impact on Hong Kong citizens and expatriates. The contents of the anti-avoidance tax provisions will be covered in the next article.

PRC tax resident

The Mainland adopts a worldwide taxation concept. As such, individuals who are PRC tax residents are subject to IIT on their worldwide income (that is, both PRC sourced and non-PRC sourced income), while non-PRC tax residents are subject to IIT on PRC sourced income only. As such, the taxing rights on non-PRC sourced income (for example, income arising from Hong Kong) differentiates between PRC tax residents and non-PRC tax residents.

According to the IIT law, an individual is considered a PRC tax resident if one of the following conditions is fulfilled:

• the individual is domiciled in the Mainland (domicile factor), or

• the individual has resided in the Mainland for 183 days or more in a calendar year (time factor).

An individual is domiciled in the Mainland if he/she habitually resides in the Mainland by reason of permanent registered address, family ties or economic interests. An individual with a household registration in the Mainland or a Mainland Chinese passport is generally regarded as domiciled in the Mainland and is thus considered a PRC tax resident.

Two relaxations to the worldwide taxation system for IIT were subsequently introduced in relation to the time factor. Please note that these are only applicable to a non-Mainland domiciled individual. In contrast, a Mainland domiciled individual is subject to IIT on his/her worldwide income no matter the length of his/her stay in the Mainland.

1. IIT implementation rules

Article 4 of the amended IIT implementation rules points out that non-PRC sourced income that is paid or borne by a non-PRC enterprise(s) or individual(s) is only subject to IIT if that individual, who is not domiciled in the Mainland:

• has resided in the Mainland for 183 days or more during each year of the preceding six consecutive calendar years, and

• did not stay outside the Mainland for more than 30 days in one single trip during any one of the preceding six consecutive years.

In this case, the individual would be subject to IIT on his/her worldwide income starting from the seventh year onward.

The Public Notice [2019] No 34 (Notice No 34) jointly issued by the Ministry of Finance and the State Administration of Taxation has further provided that the abovementioned ‘six consecutive years’ will be counted retroactively, starting from 1 January 2019. In this connection, 2025 would be the earliest year that a non-Mainland domiciled individual may be subject to IIT on his/her worldwide income.

It has been common practice for Hong Kong citizens who require frequent travel to the Mainland to stay in Hong Kong for more than 30 consecutive days once every few years in order to avoid being subject to IIT on his/her worldwide income. This practice is commonly referred to as a ‘tax break’.

2. Day-counting rule

In the past, an individual was considered to reside in the Mainland for one whole day even if he/she was only there for part of the day. As such, for a Hong Kong individual who travelled to the Mainland to work from Monday to Friday, he/she would have been counted as residing in the Mainland for more than 183 days in the year, even if he/she travelled back to Hong Kong every day. It is also interesting to note that an individual could have been considered to reside in Hong Kong for more than 180 days and in the Mainland for more than 183 days during the same year, and thus could have been simultaneously regarded as both a Hong Kong and a PRC tax resident.

Notice No 34 revised the above day-counting rule. In particular, an individual is now only considered to be residing in the Mainland for one day if he/she stays there for the ‘whole day’ (that is, a consecutive period of 24 hours in the same day, or from 12am to the following 12am). This relaxation is significant to Hong Kong citizens who frequently travel to the Mainland to work, but who come back to Hong Kong regularly after their working week. For instance, a Hong Kong citizen who works in the Mainland during the week, arriving on Monday and leaving on Friday, would now be considered as residing in the Mainland for three days per week under the new rule (instead of five days under the old rule), because they are only there for part of the day on both Monday and Friday. This revision makes a huge difference as that individual would now be counted as residing in the Mainland for less than 183 days in a year under the new rule, as opposed to more than 183 days under the old rule.

On the other hand, for Hong Kong citizens working in the Greater Bay Area, it is common for them to travel back to Hong Kong every day after their work. Under the new rule, it is quite certain that he/she will be counted as residing in the Mainland for less than 183 days every year.

To conclude, with the above two relaxations, the risk of being subject to IIT on worldwide income has been lowered significantly.

PRC sourced income

After examining the definition of a tax resident, you may be interested to know that any income which is specifically defined as ‘PRC sourced income’ is still subject to IIT even when an individual is not a PRC tax resident. In this article, we will focus on employment and office income.

There is a common misconception that the source of remuneration received by an employee depends on the location of the employer – in other words that remuneration received, for example from a Hong Kong company, would only be subject to Hong Kong salaries tax.

In fact, the source of employment income is generally defined as the location in which the employee provides the services. As such, if an individual receives employment income from a Hong Kong company but travels to the Mainland to work, his/her income is considered to be PRC sourced income.

Having said that, for directors and senior management personnel – even when he/she performs duties outside the Mainland – if their employment or office income is derived from a Mainland entity or the Mainland permanent establishment of a foreign entity, his/her income is still considered as PRC sourced income.

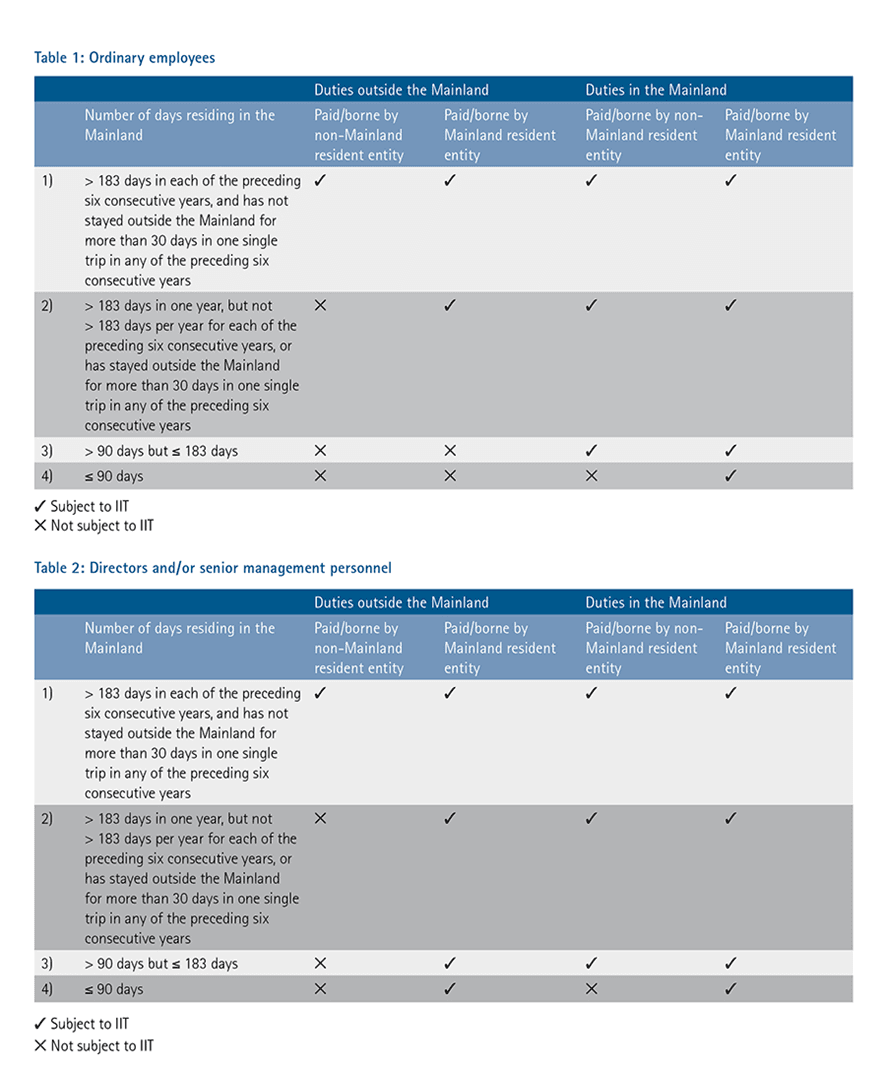

Tables 1 and 2 summarise the respective IIT implications for non-Mainland domiciled individuals who are (i) ordinary employees or (ii) directors and/or senior management personnel, under different scenarios.

IIT tax calculation

For individuals who work both in the Mainland and outside the Mainland (such as in Hong Kong) during the year, their IIT liabilities involve complex calculations which cannot be easily addressed in this article. However, we list below a number of factors that will affect their IIT liabilities:

• whether the individual is a director or senior management personnel or not

• whether the remuneration was paid/borne by a Mainland entity, a non-Mainland entity or co-paid/borne by Mainland and

non-Mainland entities, and

• the number of working days in the Mainland.

In this regard, we would like to highlight that the definitions of ‘working day’ and ‘day of residence’ are different. As explained above, the definition of days of residence has been changed such that only a whole day (that is, a 24-hour period on the same day) is calculated as one day. As for the working day, staying less than 24 hours in the Mainland during a day is still counted as half a working day.

Last piece of advice

Last but not least, in the case of a Hong Kong individual resident, a tax credit is available if the same income is subject to both IIT and Hong Kong salaries tax under the Double Taxation Arrangement between Hong Kong and the Mainland. As such, the overall tax liabilities in Hong Kong and the Mainland should be considered when you plan ahead.

The article provides a comprehensive overview of the recent PRC Individual Income Tax reforms. The explanation of the new tax resident criteria and day-counting rules is particularly insightful for professionals like me who frequently travel between Hong Kong and the mainland.

This was an excellent breakdown of the complex changes in the PRC tax law. The FAQs were a helpful summary to circulate within our company.