After implementing Transfer Pricing Law for a few years, Hong Kong Inland Revenue Department is now ready to impose more Transfer Pricing Audit on Hong Kong Tax Payers and request taxpayers to prepare and submit Transfer Pricing Documentation. Cheng & Cheng Taxation Services Limited (“Cheng & Cheng Taxation”) will further reveal the importance of balancing interests of HKIRD in Transfer Pricing, with the below discussion areas:

• two common scenarios when the IRD carries out transfer pricing adjustment in Hong Kong;

• the penalties of lacking proper documentation; and

• the reasons of preparing benchmarking studies

Renowned for being one of the lowest tax rate jurisdictions, and for its conducive business environment, Hong Kong is a place in which multinational corporations (MNCs) tend to allocate more profits in order to lower the overall group effective tax rate. The Hong Kong Inland Revenue Department (IRD) definitely welcomes this. However, with the adoption of Automatic Exchange of Information (AEOI), tax filings submitted to the IRD may be shared with other tax authorities. As such, the transfer pricing policies of MNCs must balance the interests of all relevant tax authorities, not limited to the IRD. Henry Kwong, Tax Partner of Cheng & Cheng Taxation said "MNCs should not overlook the importance of Hong Kong in their Transfer Pricing Policy, from both a compliance and tax planning perspective."

There have previously been occasions where a group sacrificed Hong Kong in their transfer pricing policies. However, with the implementation of the transfer pricing law in July 2018, tax adjustments can now be made to Hong Kong entities with a less than reasonable level of profits. More importantly, penalties up to the amount of tax undercharged can be imposed in the absence of proper transfer pricing documentation.

Scenario 1: Assigning big losses to Hong Kong entities during a recession

Thanks to the closure of border due to Covid-19 pandemic and skyrocketing inflation across the globe, the year 2022 has undoubtedly been a difficult one for MNCs and Mainland China Enterprises. It can be a real headache for in-house tax specialists to apply their transfer pricing policies as the overall profit margin of the group plunges. As the group will have already entered into either advance pricing arrangements or informal agreements with tax authorities in other operating jurisdictions, they may still have to assign a certain percentage of the profit margin to those jurisdictions, despite the profit slump. In the past, a group was left with no alternatives but to allocate substantial losses to Hong Kong entities of the group. This is now impossible since the IRD is likely to impose transfer pricing adjustments and will not accept the losses.

Scenario 2: Hong Kong as a collection and payment hub

Hong Kong enterprises are commonly assigned to be the "collection and payment hub" of a group to collect and make payments on behalf of its group companies in other jurisdictions to get around foreign exchange control restrictions. From an accounting perspective, these transactions may be booked as sales and cost of sales without any markup. These break-even transactions lower the overall operating profit margin of the Hong Kong entity despite a "nil" effect on the absolute amount of profit. However, the corporation's lower overall profit margin may trigger the attention of tax authorities, especially when the margin is lower than the industry average.

Importance of proper transfer pricing documentation in Hong Kong

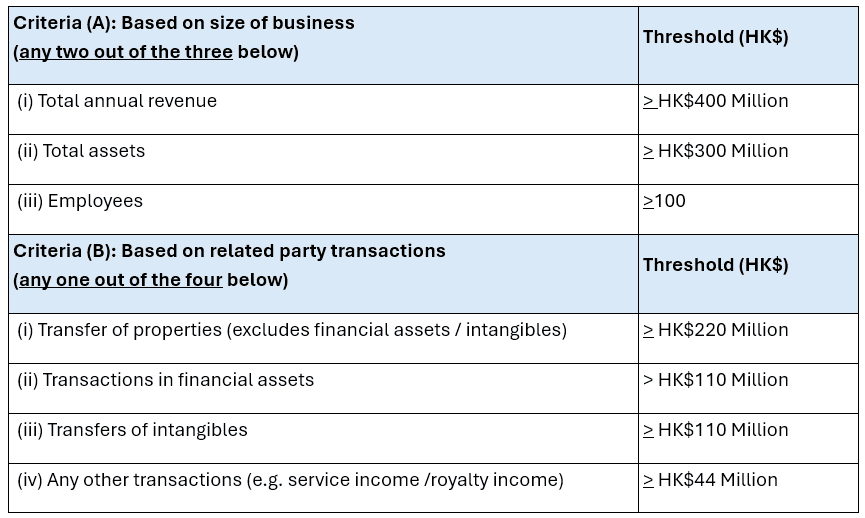

As in other jurisdictions, transfer pricing documentation in Hong Kong comprises Master File, Local File and Country-by-Country (CbC) reporting. While following the universal threshold of group consolidated revenue of EUR750 million for a CbC report, the threshold for Master File and Local File in Hong Kong is rather complicated (see Table 1).

Table 1: Threshold for Master File and Local File

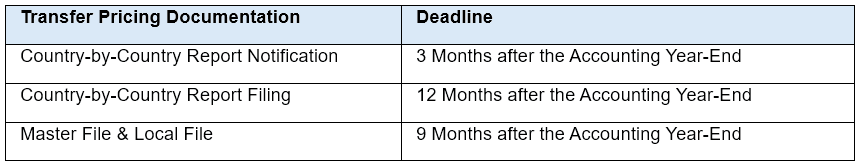

Table 2: Deadline of preparing Transfer Pricing Documentation in Hong Kong

As mentioned above, failure to prepare proper documentation can trigger not only administrative fines, but also penalties up to the amount of tax undercharged in the case of transfer pricing adjustments. More pertinently, no tax credit will be granted in other tax jurisdictions for such penalties.

Applying the same logic, there is a growing trend for MNCs to prepare benchmarking studies, even when their size does not meet the required threshold, for the following reasons: -

Tax authority challenge

• The IRD is increasingly eager to request a benchmarking study, even if the corporation does not meet the threshold for preparing

transfer pricing documentation, especially in the case of high gross profit fluctuation;

• Field investigation by the IRD can be a painful process. A benchmarking study is often very helpful in reaching a compromise

settlement, such as in the case of failure to maintain proper accounting records.

Tax advisory on operational change

• Thanks to its low tax rate, Hong Kong is still a place in which many corporations prefer to allocate more profits. Given the current

global situation, many MNCs are considering to shift their location of operations. Making use of this opportunity, they are

eager to set up substance in Hong Kong to justify their profit allocation.

Initial Public Offering in Hong Kong

• Authorities now customarily request benchmarking report from corporations wishing to list on the Hong Kong Stock Exchange in

order to assess their tax risk after getting listed in Hong Kong.

As a last piece of advice, with the implementation of the Common Reporting Standard (CRS) and AEOI, global tax authorities are more intent on targeting foreign corporations operating in local tax jurisdictions, normally in the form of a Permanent Establishment (PE). While the arguments about the existence of PEs continue, transfer pricing is a preferred means of resolving PE tax disputes. As such, it is essential that MNCs review their current operations and update their transfer pricing policies to reduce their transfer pricing risk.

As a CFO, I find Henry's insights on balancing the interests of the Hong Kong Inland Revenue Department in transfer pricing extremely valuable. His guidance has helped us navigate the complexities of transfer pricing compliance and ensure our policies are aligned with Hong Kong's regulations.

Henry and the team have provided us with invaluable assistance in understanding the nuances of transfer pricing in Hong Kong. Their expertise in this area has been a great asset, helping us avoid potential pitfalls and ensure compliance with the latest regulations.