Hong Kong is one of the latest tax jurisdictions to codify its own transfer pricing law, with 2020 being the first year for some Hong Kong corporations to prepare transfer pricing documentation.

Renowned for being one of the lowest tax rate jurisdictions, and for its conductive business environment, Hong Kong is a place in which multinational corporations (MNCs) tend to allocate more profits in order to lower the overall group effective tax rate. The Hong Kong Inland Revenue Department (IRD) definitely welcomes this. However, with the adoption of Automatic Exchange of Information (AEOI), tax filings submitted to the IRD may be shared with other tax authorities. As such, the transfer pricing policies of MNCs must balance the interests of all relevant tax authorities, not limited to the IRD. Henry Kwong, Tax Partner of Cheng & Cheng Taxation Services said "MNCs should not overlook the importance of Hong Kong in their Transfer Pricing Policy, from both a compliance and tax planning perspective."

There have previously been occasions where a group sacrificed Hong Kong in their transfer pricing policies. However, with the implementation of the transfer pricing law in July 2018, tax adjustments can now be made to Hong Kong entities with a less than reasonable level of profits. More importantly, penalties up to the amount of tax undercharged can be imposed in the absence of proper transfer pricing documentation.

Scenario 1: Assigning big losses to Hong Kong entities during a recession

Due to the US--China trade war and the Covid-19 pandemic, the year 2020 will undoubtedly be a difficult one for MNCs. It can be a real headache for in-house tax specialists to apply their transfer pricing policies as the overall profit margin of the group plunges. As the group will have already entered into either advance pricing arrangements or informal agreements with tax authorities in other operating jurisdictions, they may still have to assign a certain percentage of the profit margin to those jurisdictions, despite the profit slump. In the past, a group was left with no alternative but to allocate substantial losses to Hong Kong entities of the group. This is now not possible since the IRD is likely to impose transfer pricing adjustments and will not accept the losses.

Scenario 2: Hong Kong as a collection and payment hub

Hong Kong enterprises are commonly assigned to be the "collection and payment hub" of a group to collect and make payments on behalf of its group companies in other jurisdictions to get around foreign exchange control restrictions. From an accounting perspective, these transactions may be booked as sales and cost of sales without any markup. These break-even transactions lower the overall operating profit margin of the Hong Kong entity despite a "nil" effect on the absolute amount of profit. However, the corporation's lower overall profit margin may trigger the attention of tax authorities, especially when the margin is lower than the industry average.

Importance of proper transfer pricing documentation in Hong Kong

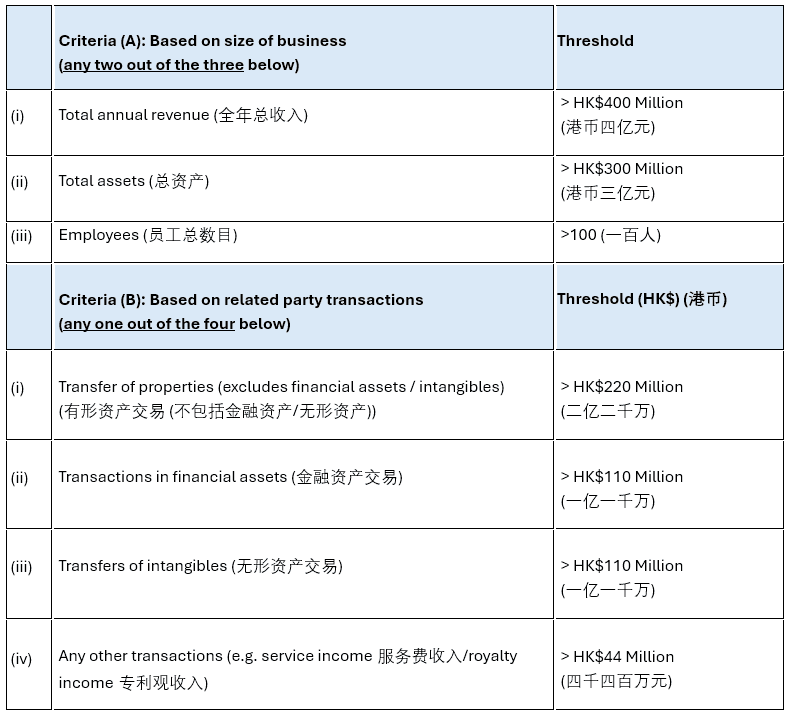

As in other jurisdictions, transfer pricing documentation in Hong Kong comprises Master File, Local File and Country-by-Country (CbC) reporting. While following the universal threshold of group consolidated revenue of EUR750 million for a CbC report, the threshold for Master File and Local File in Hong Kong is rather complicated (see Table 1). In this regard, March year-end corporations should have prepared their first Master File and Local File documentation last year, while 30 September 2020 is the due date for December year-end corporations.

Table 1: Threshold for Master File and Local File

As mentioned above, failure to prepare proper documentation can trigger not only administrative fines, but also penalties up to the amount of tax undercharged in the case of transfer pricing adjustments. More pertinently, no tax credit will be granted in other tax jurisdictions for such penalties.

Applying the same logic, there is a growing trend for MNCs to prepare benchmarking studies, even when their size does not meet the required threshold, for the following reasons:-

Tax authority challenge

The IRD is increasingly eager to request a benchmarking study, even if the corporation does not meet the threshold for preparing transfer pricing documentation, especially in the case of high gross profit fluctuation; Field investigation by the IRD can be a painful process. A benchmarking study is often very helpful in reaching a compromise settlement, such as in the case of failure to maintain proper accounting records.

Tax advisory on operational change

Thanks to its low tax rate, Hong Kong is still a place in which many corporations prefer to allocate more profits. Given the current global situation, many MNCs are considering shifting their location of operations. Making use of this opportunity, they are eager to set up substance in Hong Kong to justify their profit allocation.

Initial Public Offering in Hong Kong

Authorities now customarily request transfer pricing information from corporations wishing to list on the Hong Kong Stock Exchange.

As a last piece of advice, with the implementation of the Common Reporting Standard (CRS) and AEOI, global tax authorities are more intent on targeting foreign corporations operating in local tax jurisdictions, normally in the form of a Permanent Establishment (PE). While the arguments about the existence of PEs continue, transfer pricing is a preferred means of resolving PE tax disputes. As such, it is essential that MNCs review their current operations and update their transfer pricing policies to reduce their transfer pricing risk.

The Hong Kong transfer pricing codification has made compliance stricter but clearer. The guidelines are transparent, and although it requires extra documentation work, it's worth the effort to avoid penalties.

Our company adapted quickly to the new documentation requirements, thanks to the detailed guidance. The benchmarking process has helped us optimize our profits and reduce potential tax disputes.